May 2021 – The Queen’s Economics Department (QED) has been at the forefront of research into the COVID-19 pandemic. Studying the pandemic’s economic and social effects, QED faculty research has led the way in analyzing the effects of COVID on economic outcomes, producing instructive findings with implications for policy makers and governments.

Members of the QED affiliated with the John Deutsch Institute for the Study of Economic Policy (JDI) have influenced government strategy through their engagement of policymakers and involvement on national task forces and think tanks, and through their academic research and policy briefs.

Modeling Economic Impact

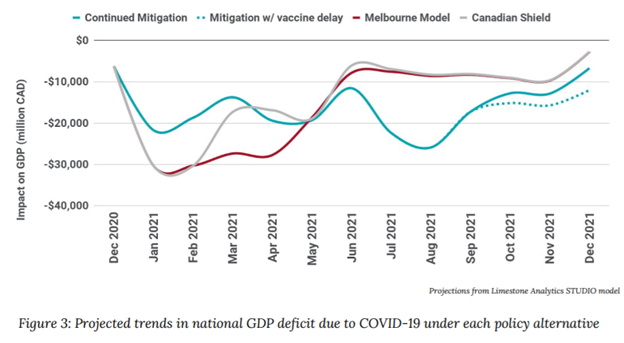

Another way in which QED economists have shaped policy is through the development of models to assess the impact of COVID-19 on the economy. One of these efforts that has had remarkable influence on policy in Canada, and elsewhere, is the STUDIO model [1] developed by a team of economists from the QED and Limestone Analytics. The team included Dr. Cotton, Brett Crowley, Dr. Bahman Kashi, Dr. Huw Lloyd-Ellis, and Ph.D. candidate Frederic Tremblay. Their model allows them to estimate the economic costs of alternative lockdown and recovery strategies proposed by policymakers and public health officials. The model has been used to author numerous policy briefs at the request of provincial and federal policymakers, and it was the foundation for the Economic Impact Explorer dashboards released by Limestone Analytics and Local Intel, as well as the Eastern Ontario Leadership Council’s COVID-19 economic impact tool and Canada’s Digital Technology Supercluster Looking Glass project.

The STUDIO model provided the economic analysis for Global Canada’s COVID Strategic Choices Group, a task force of business leaders, policymakers, and academics brought together to assess the scientific evidence around the epidemiological and economic impacts of alternative lockdown strategies to recommend a path forward for provincial and federal governments. Their “Canadian Shield” proposal [2] gained a lot of media attention and shaped policy decisions at the provincial and national levels. Dr. Cotton served as the economic modeling lead for the group. The model is also the primary macroeconomic model for the One Society Network, a nationwide network of researchers funded by the Public Health Agency of Canada (PHAC) and the Natural Sciences and Engineering Research Council of Canada (NSERC). The network is working towards increasing Canada’s capacity at infectious disease modeling, bringing together experts in both economics and epidemiology. Dr. Cotton is the co-director of the network, and Dr. Lloyd-Ellis is leading the network’s macroeconomic modeling efforts.

The STUDIO model has also been applied to model the economic costs of COVID-19 in Malawi and Rwanda. For example, it was used as a quantitative method that added estimates of national income and employment income to four different modeled scenarios of how Malawi could emerge from the COVID-19 crisis by 2025 in analysis undertaken by a team of economist from the QED and Limestone Analytics in partnership with the Malawi National Planning Authority and the Copenhagen Consensus Center [3]. It has also been used to compare outcomes under alternative stimulus spending policies in Malawi [4].

Other efforts to model the macroeconomic and labour force impacts of COVID-19 include the work by Dr. Brant Abbot and PhD candidate Nam Phan. The vast majority of OECD countries introduced either expanded unemployment benefits or a wage subsidy program to counter the negative economic effects of COVID-19. For this reason, the question of which of these two policies is more effective is important for crafting public policy. Dr. Abbot and Phan studied the efficacy of wage subsidies in a pandemic relative to enhancing unemployment benefits [5]. The research developed a model of the economic transitions from a pandemic shock through to full economic recovery and used it to study alternative pandemic wage subsidy and unemployment benefits programs on the labour market and household welfare. They show that it is optimal to subsidize most of the wages of affected workers up to a weekly ceiling. Low-income workers benefited the most from the wage subsidy, while high-income workers on average experienced a welfare loss under the optimal wage subsidy scheme. Finally, it was found that there are substantial welfare gains from implementing a wage subsidy and enhanced unemployment benefits jointly, as opposed to one or the other.

Assessing the Policy Response and Planning for Future Crises

Dr. Frank Milne and Dr. David Longworth together produced several working papers studying the pandemic that provided an instructive picture of key areas in which governments failed to adequately prepare for the crisis and made recommendations for reforms to prepare for future pandemics. Their papers are being developed into a book for World Scientific Publishing.

Among other things, they show that in far too many cases forensic report recommendations of previous pandemics were ignored. They found that substantial weaknesses in the preparation by public health authorities and governments increased the health and economic costs of the COVID-19 pandemic relative to what they would have been if pre-existing recommendations had been followed and a wider set of plans had been put into place [6]. They also produced a working paper discussing 10 parallels between the lack of preparation of financial system regulators prior to the Global Financial Crisis and the lack of preparation by public health authorities and governments prior to COVID-19. The paper considered the steps that were taken to deal with each of the deficiencies in financial system regulation following the Global Financial Crisis as well as the parallel steps that now need to be taken to deal with the deficiencies in pandemic planning [7]. Apart from the direct economic consequences due to illness and death from the virus, the main economic and financial costs during the COVID-19 crisis have been due to the varying degrees of preventative measures taken by the public, firms, and governments that directly impacted economic and financial activity. Thus, there is an important interdependence between economic, financial, and health policy actions, and a working paper produced by Dr. Milne and Dr. Longworth that proposes the use of regular, combined medical, economic and financial stress tests and wargames in preparing for future pandemics and other major environmental shocks [8] provided key insights for policymakers preparing for the next pandemic. Dr. Milne and Dr. Longworth produced another forward-looking working paper which sets forth recommendations for carrying out post-mortems on the COVID-19 experience, planning for future pandemics, and establishing transparent and accountable governance systems for ongoing implementations of pre-pandemic plans [9]. This work has the potential of helping future policymakers avoid the substantial weaknesses in the preparation for the COVID-19 pandemic that increased health and economic costs.

In a similar vein, Dr. Robin Boadway and Dr. Christopher Cotton were invited to join the Royal Society of Canada’s COVID-19 working group on economic recovery, releasing a policy report highlighting how the pandemic has revealed weaknesses in government and society that need to be addressed so that Canada can emerge from the crisis with a stronger foundation than they entered it [10]. The working group’s briefing focused on advising policymakers on steps that can be taken to build a better Canada out of the pandemic and addressing how Canada can renew its social contract which ensures all people in society have the chance to live a dignified life. The briefing recommended developing systems that enable more efficient and effective policy response across provinces and in collaboration with the federal government. It also recommended that the federal and provincial governments seriously assess the feasibility of a basic income guarantee (BIG), the reform of provincial and federal labour codes to ensure paid sick leave, and more support for universal access to childcare and early childhood education. It also urged the government to implement a comprehensive tax reform that enhances the fairness of taxes by broadening the tax base to treat all capital income on a par with earnings and address intergenerational transmission of wealth inequality by re-instituting an inheritance tax.

Additionally, Dr. Thorsten Koeppl served on the C.D. Howe Working Group on Monetary and Financial Measurement, releasing a series of policy memos [11] [12] [13] [14] to guide policy making in Canada.

COVID’s Impact on Housing

Dr. Sitian Liu, in collaboration with colleagues from the Federal Reserve Bank of Dallas, was the first to study the effects of the pandemic on neighborhood-level spatial variation in housing demand, and to test its underlying driving forces [15]. Using several local housing indicators such as inventory, home price, and rent to track the spatial difference in the change of housing demand, Dr. Liu and colleagues found that the pandemic has led to a shift in housing demand away from neighborhoods with high population density towards the suburbs and neighborhoods with lower population density. The results suggest that the reduced demand for dense neighborhoods may persist even as the economy recovers. Lastly, a significant shift in housing demand away from cities with a greater share of telework jobs and higher pre-COVID-19 home values was found, although the magnitude is smaller than the within-city shift. Dr. Liu’s research contributes to the literature on how city structures change in the presence of the dispersion forces of diseases and may be useful for policymakers trying to understand these forces and their impact on the economy and society.

Dr. Robert Clark and colleagues produced research studying the effectiveness of debt-relief programs targeting short-run household liquidity constraints implemented in Canada following the COVID-19 outbreak [16]. These programs, offered by financial institutions during the pandemic with backing from the federal government, the banking regulator, and the Canada Mortgage and Housing Corporation (CMHC), offered a number of options to borrowers to alleviate their financial obligations in a context of job losses and economic insecurity. Dr. Clark and colleagues, using credit-bureau data, showed that even though these programs offered important savings to Canadians who opted in, enrollment was low. In addition, they documented that this outcome was mainly due to a mix of limited information about the programs and fixed non-monetary costs associated with enrollment. In a context where the debt-relief programs were implemented to minimize personal defaults and to help stabilize the economy, these findings have important policy implications.

COVID’s Impact on Trade

Another important effect COVID-19 had on Canada is the effect that the pandemic-induced border closure had on Canadian communities near the border. Dr. Beverly Lapham and colleagues produced research studying this effect [17]. They use community-level data on border crossings to estimate the shifts in retail spending due to COVID related travel restrictions.

During normal times, Canadian retailers near the border see a loss in potential revenue due to cross-border shopping by Canadian consumers. COVID travel restrictions have reduced these losses. reduces these losses. Such “foregone losses” differed across community and industry, with gas stations and accommodation services, as well as retailers located in less affluent Canadian communities with nearby US shopping options seeing the largest foregone losses (or benefits) from the restricted travel. By quantifying the revenue losses associated with cross-border shopping, the research can inform future policy decisions which restrict or facilitate the ability of Canadians to purchase goods and services from foreign retailers.

Faculty of the John Deutsch Institute have been leaders of research into the effects of the COVID-19 pandemic and have provided instructive analysis that has been relevant to policymakers and public officials seeking to craft public policy to guide Canada out of the pandemic and plan for the future.

Engaging Graduate Students

The department’s initiatives around COVID-19 research have presented many opportunities for the engagement of graduate students. Ph.D. Candidate Frederic Tremblay was an instrumental collaborator on the development of the STUDIO model and its applications to shape policy in Canada and internationally. He is receiving NSERC funding from the One Society Network to continue this work as a post-doc, and to participate in a nationwide network of leading researchers working at the intersection of economics and public health in order to better prepare Canada for the next crisis.

Additionally, five Queen’s Economics Department graduate students received rapid response research grants from Mitacs to work on COVID-19 research. Ph.D. students Ludovic Auger, Baiyou Chen, Rebecca Dafoe, Mahtab Hanzroh, and Nam Phan each received financial support to conduct research on different topics related to the impact of COVID-19 on economic outcomes over the summer of 2020, several of whom have continued this research. The funding was secured by Professors Christopher Cotton and Huw Lloyd-Ellis with support from the Faculty of Arts and Sciences in order to engage students on the JDI’s COVID research team. Several MA students are also actively engaged in COVID-19 related research as they work to complete MA essays on related topics.

References

[1] Cotton, C., Crowley, B., Kashi, B., Lloyd-Ellis, H., and Tremblay, F. (2020). Quantifying the Economic Impacts of COVID-19 Policy Responses on Canada’s Provinces in (Almost) Real-Time. QED Working Paper Number 1441.

[2] Agnew, M., Ayinde, T., Beaulieu, A., Colijn, C., Cotton, C., Crowe, M., Dhalla, I., Ferbey, J., Greenhill, R., Haggart, B., House, B., Imgrund, R., Jebwab, J., Khangura, J., Kwong, J., McCabe, C., Morris, A., Soucy, J.P. R., and Tuite. A. (2020). Building the Canadian Shield: A New Strategy to Protect Canadians from COVID and from the Fight Against COVID. Global Canada, COVID Strategy Choices Group.

[3] Brady, C., Cotton, C., Crowley, B., Davis, S., Farquharson, C., Kashi, B., Lloyd-Ellis, H., and Tremblay, F. (2020). Emerging from Crisis: Applying Scenario Planning in Malawi. Limestone Analytics and JDI Policy Paper 20-1201.

[4] Crowley, B., and Tremblay, F. (2021). Optimizing COVID-19 Stimulus Spending in Malawi. Limestone Analytics and JDI Policy Paper 21-0301.

[5]

[6] Milne, F., and Longworth, D. (2020). Covid-19 and the Lack of Public Health and Government Preparation. QED Working Paper Number 1436.

[7] Milne, F., and Longworth, D. (2021). Parallels Between Financial Regulation Prior to the Global Financial Crisis and Lack of Public Health Preparation Prior to Covid-19. QED Working Paper Number 1455.

[8] Milne, F., and Longworth, D. (2020). Preparing for Future Pandemics: Stress Tests and Wargames. QED Working Paper Number 1437.

[9] Milne, F., and Longworth, D. (2021). Public Health and Government Preparations For Future Pandemics. QED Working Paper Number 1451.

[10] McCabe, C., Boadway, R., Lange, F., Gold, E.R., Cotton, C., Adamowicz, W., Breznitz, D., Elgie, S., Forget, E., Jones, E., de Marcellis-Warin, N., Peacock, S., Tedds, L. (2020). Renewing the Social Contract: Economic Recovery in Canada from COVID-19. RSC Policy Briefing, Royal Society of Canada COVID-19 Task Force.

[11] https://www.cdhowe.org/council-reports/enhanced-government-credit-facility-needed-crisis-working-group-monetary-and-financial-measures

[12] https://www.cdhowe.org/council-reports/time-essence-ceba-crisis-working-group-monetary-and-financial-measures

[13] https://www.cdhowe.org/council-reports/expanded-bank-canada-balance-sheet-requires-balancing-act-crisis-working-group-monetary-and

[14] https://www.cdhowe.org/council-reports/guidelines-and-creativity-key-restoring-financial-confidence-crisis-working-group-monetary-and

[15] Liu, S., and Su, Y. (2021). The Impact of the COVID-19 Pandemic on the Demand for Density: Evidence from the U.S. Housing Market. JDI Policy Paper 21-0401.

[16] Allen, J., Clark, R., Li, S., and Vincent, N. (2021). Debt-relief programs and money left on the table: Evidence from Canada’s response to Covid-19. JDI Policy Paper 21-0102.

[17] Baggs, J., Fung, L., and Lapham, B. (2021). An Empirical Evaluation of the Effect of Covid-19 Travel Restrictions on Canadians’ Cross Border Travel and Canadian Retailers. QED Working Paper Number 1457.